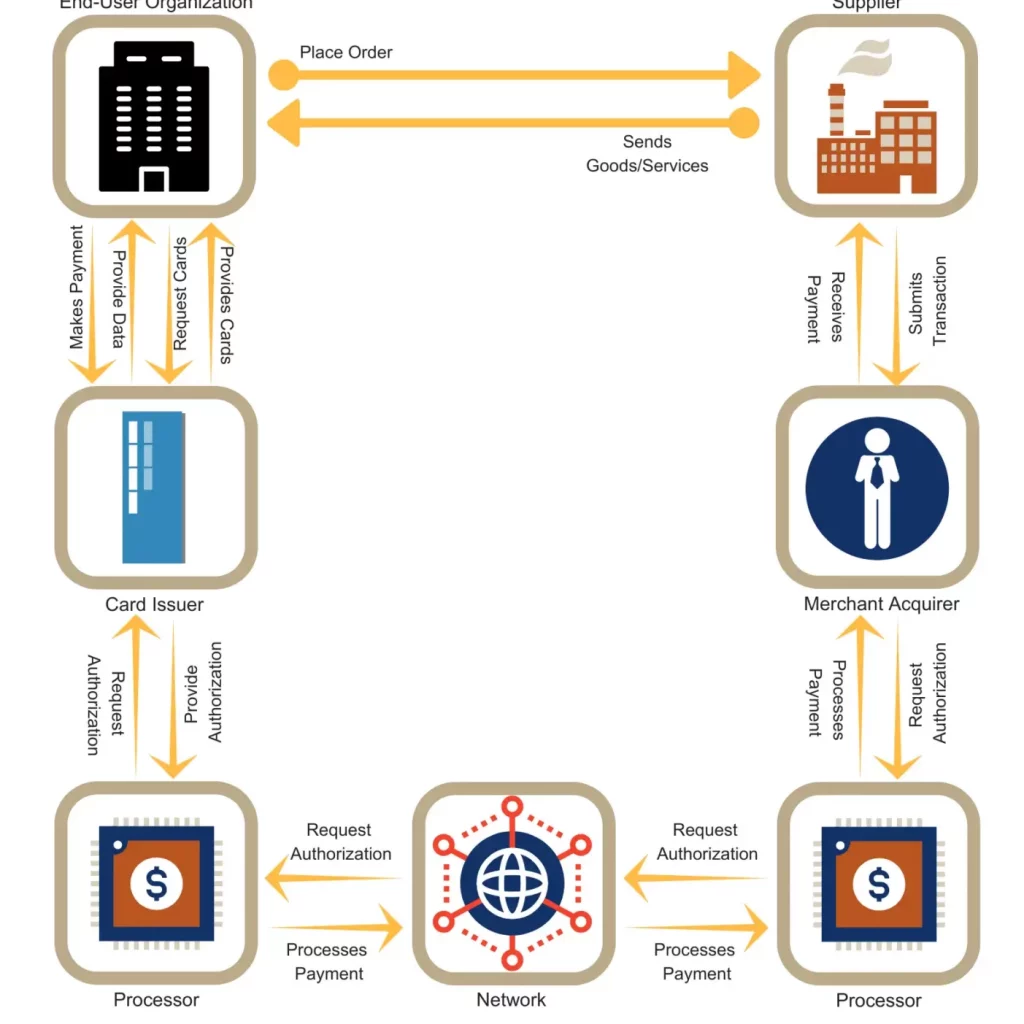

AMEX (American Exchange) is renowned for its financial services to corporates, offering AMEX purchase cards to employees for company expenses. One of our clients, a non-profit organization, adopted multiple AMEX purchase cards for its employees. The finance team faced the challenge of managing and recording these transactions in NetSuite, prompting the need for seamless card integration.

The Challenge:

AMEX purchase card can be availed by any Bank in the United States of America. Herein, an important feature to consider, AMEX offers its centralized portal to track and manage expenses done by the card(s). AMEX provides daily transaction reports that can be extracted in pdf or CSV, designed in a unique structure followed by banking and financial systems. The finance team had to download the day-to-day report and create a manual entry in NetSuite. This was a huge task and cost the company hundreds of hours monthly, in turn affecting productivity and profitability.

The Analysis:

We detailed and analyzed their process, facilities, needs, and accounting habit. These were the core challenges and observations by the STREAMS team:

- In various instances, the employees’ names were recorded differently with AMEX than with the organization.

- AMEX provided transaction reports following their standardized structure opted by the banking system, known as EDI. That was a completely different structure to NetSuite or other software’s.

- Credit card bills were generated monthly, on a pre-defined date. But, in some circumstances, the billing dates were extended. Hence, affecting the report for a maximum day that is defined, which was a challenging part to oversee.

The Solution:

STREAMS proposed to automate all these processes involved from expense tracking in the AMEX portal to entry creation, reconciliation, and reporting in NetSuite by the AMEX P Card to NetSuite Integration.

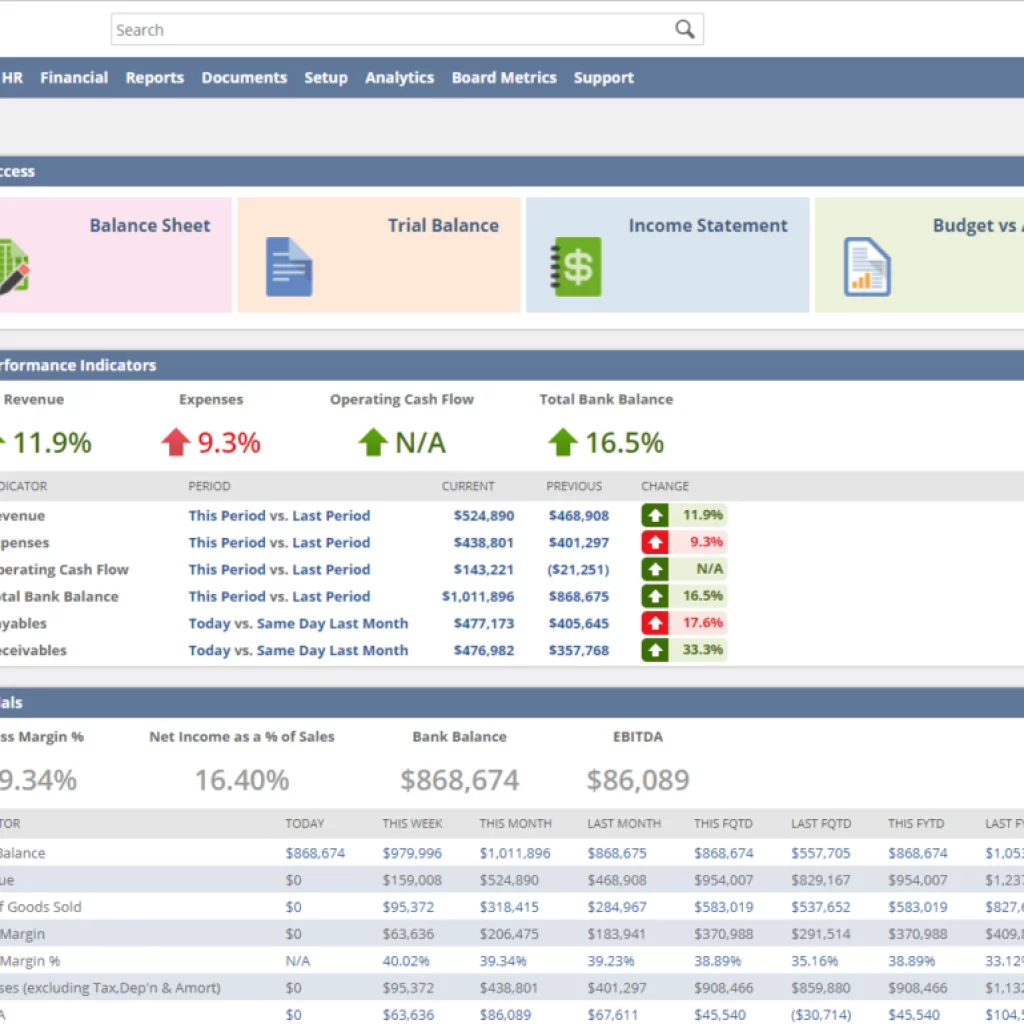

With the AMEX Purchase Card Integration with NetSuite, you can automatically import, and track expenses charged by employees to their corporate American Express (AMEX) cards. It can be set up to important transactions on daily basis in NetSuite that can be mapped in pre-defined expense categories.

NetSuite uses these credentials to access all corporate card transactions from your employees. The transactions are downloaded and imported into a single file. With Integration, you will have the ability to:

- Validate expense lines daily

- Have corporate card charges automatically available in the system, which can be mapped to categorized expense journals.

- Provide automatic email notification to employees about their newly imported charges.