When performing NetSuite reconciliation during month-end and year-end closures, several key factors must be considered. This includes properly setting up periods, carrying out activities linked to closing periods, and understanding the relevant features and preferences. The system requires minimal additional operations for year-end, but essential tasks like 1099 processing and record maintenance still need attention. With time, the NetSuite reconciliation process will become more streamlined and efficient.

Managing Accounting Periods

Period Start: Before adding transactions into NetSuite, a fiscal year and base periods must be setup. Your period structure is a crucial decision when setting up a fiscal year. Standard calendar months, 4 Weeks, and 4-4-5 Weeks are the three alternatives.

- You can choose whether or not to permit non-G/L changes to transactions in a closed period once your fiscal year has been configured. Within a fiscal year, this checkbox is chosen one period at a time. The update of the note field on a vendor bill is an example of a non-G/L alteration.

- You will observe that each of your accounting periods will be in one of the following three statuses when accessing them on the Manage Account Periods page:

- Unlocked: There are no limitations on posting transactions.

- Locked: No transactions may be created or modified by users without the Override Period Restriction permission.

- Closed: No users, not even administrators, are permitted to publish or alter transactions in a way that might affect the G/L.

Read Also: 5 Best NetSuite Integrations

Listed below are additional information on locking and closing times:

- If modifications are required, previously closed periods may be reopened. When reopening a period, NetSuite ERP will demand that a justification cause be recorded.

- The current period cannot be closed until all previous periods have been completed.

- Any shuttered periods will reopen upon a period’s reopening.

- Quick Close Accounting Preference allows you to close many periods with a single click. It is crucial to note that the Quick Closing tool does not do any of the period close activities, therefore using this functionality while closing a period for the first time is not recommended.

Period Close Checklist Tasks

- Once all transactions for the month are complete, go to the Period Close Checklist on the Manage Accounting Periods page to begin your NetSuite reconciliation. The tasks required for month-end reconciliation depend on the features activated in your NetSuite instance.

Read Also: Overcome the 9 Primary Financial Challenges Every Business Faces

Here are some of the most typical NetSuite period closing tasks:

- Lock A/R: Once locked, only users with the Override Period Restriction permission will be able to perform AR transactions.

- Lock A/P: Once locked, only users with the Override Period Restriction permission will be able to perform AP transactions.

- Lock All: This disables the ability to generate transactions or make journal entries that were not previously limited in the previous two phases. Users who have the Override Period Restriction access can continue to enter transactions.

- Resolve Date/Period Discrepancy: NetSuite mandates that the mismatch between the transaction date and posting period be acknowledged. You can continue with the month end checklist without aligning the two, however this will cause reporting issues.

- Examine Inventory Activity: This job displays a version of the inventory activity detail report that shows inventory balances.

NetSuite demands the acknowledgement of negative inventory balances because negative inventory is likely a suitable subject for review. You can, however, choose to close the books with negative inventory balances if you like.

- This job verifies that all inventory costing calculations have been completed. If the procedure has not yet been completed, there is a button within this activity that allows you to conduct costing calculations.

- Calculate Consolidated Exchange Rates: If you are in a OneWorld environment with subsidiaries with different base currencies, NetSuite will keep a list of consolidated exchange rates. These rates are used to convert the base currency of a child subsidiary to the parent subsidiary’s base currency.

- Revaluate Balance of Open Foreign Currency: This procedure creates currency revaluations for open customer and vendor transactions, foreign currency-denominated accounts, and other non-equity balance sheet accounts.

- Eliminate Intercompany Transactions: This procedure creates elimination journal entries for all transaction lines that have been marked for elimination.

- Audit Numbering in GL: Gapless numbering is applied to all general ledger posting transactions using this feature.

- Close: The final stage in the closing process. Once done, no user will be able to make G/L affecting additions or adjustments.

Read Also: Why a regular NetSuite Assessment is important for your business?

Year-End Recommendations

1099 processing in NetSuite necessitates the following configuration:

- Choose a 1099-Misc Category on your GL accounts as required.

- On the vendor record’s financial subtab:

- Enter the Tax ID.

- Mark the “1099 Eligible” Checkbox as needed.

- In your NetSuite environment, you may install a free 1099 bundle, which produces a saved search that searches your 1099 data points to report on vendor bill payments. This search may then be used to manually generate 1099 forms or uploaded to a third-party 1099 service provider.

- Data Maintenance:

- Examine your Vendors, Customers, GL Accounts, and so on, and deactivate any unneeded entries. This will assist to decrease clutter and make your system easier to navigate.

- Examine AR and AP Aging for past-due transactions and take appropriate action.

- Automatic Close: In NetSuite, you are not obliged to complete a formal year-end closing. After all periods have ended for the year, the system automatically concludes the year. NetSuite does not submit the sum to retained profits through journal entry since doing so would zero out previous income statements, making them unavailable for viewing. At any moment in time, the cumulative retained earnings balance on your balance sheet is made up of the retained earnings account and the net income account, with the Net Income line indicating the current fiscal year.

Read Also: Top 10 Data Integrations Tools to use for enterprise automation

Key challenges of the financial closing process in NetSuite

While the financial closing process is inherently tough, many firms suffer preventable process issues that add to the difficulties. Addressing the five most frequent financial close issues, that might significantly enhance your financial closing cycle.

Lack of standardization: The financial closing process is frequently guided by institutional memory rather than clear, defined, and written rules. Many accountants are familiar with closing operations and have done them in the same manner for years, making rigid standard operating procedures (SOPs) appear superfluous. However, just because they know how to do it doesn’t imply there isn’t potential for progress.

Lack of automation: The more actions completed manually throughout the financial closing process, the longer it will take and the more potential for error will arise. Accounting software and automation decrease the need for human operations.

Lack of integration: When the data required to execute the closure is spread across many systems, accounting professionals are obliged to manually collect and combine information. This adds time and the possibility of inaccuracy to the financial closing procedure.

Access of accurate data: A process that may rapidly become chaotic, especially if transaction data is incomplete. Accounts balance might be wrong if purchase orders, invoices, and expenditure reports are not recorded in accordance with corporate regulations. Incomplete data, on the other hand, leads the accounting team to lose time and efficiency when searching for vital facts throughout the financial closure process.

Deficiency of Time: Closing is often a tedious, time-consuming process. But, the sooner the financial close process is completed, the sooner financial statements can be provided to various stakeholders, the underlying data can be used for historical analysis, and the accounting staff can move on to more value-added responsibilities. But that’s no reason to cut corners. The final product of the financial closure, the financial statements, are frequently the Organization’s face to outside parties, and inaccuracies can harm the Organization’s reputation.

Human error: For many accountants, the closing process is one of the least fun elements of their work due to a mix of high-pressure deadlines and monotonous procedures. Accountants, for example, may spend hours or even days doing nothing more than transferring figures and double-checking computations, with the potential of errors growing as the financial closing process depends increasingly on human data entry.

Tips to overcome the closing process challenges

Break the barrier: Find and address the causes that are slowing down the process. This may have to be done gradually.

- Maintain SOPs: Create standard operating procedures outlining everyone’s responsibility and the timeframes for each stage of the financial closing process.

- Continuous accounting: Distribute the closing workload over the financial year, break-down into months. Summarize the month-end reports in your annual report.

- Data distribution: Ensure that accounting teams have access to all sources that feed into the closure and that departments have strict data input deadlines.

- Journaling templates: Make a journal entry checklist or template to verify that all pertinent information is noted and accounted for.

- Reduce manual data entry: With each keystroke, the possibility of human mistake grows. Feed data directly into accounting systems and automate data entry duties if possible.

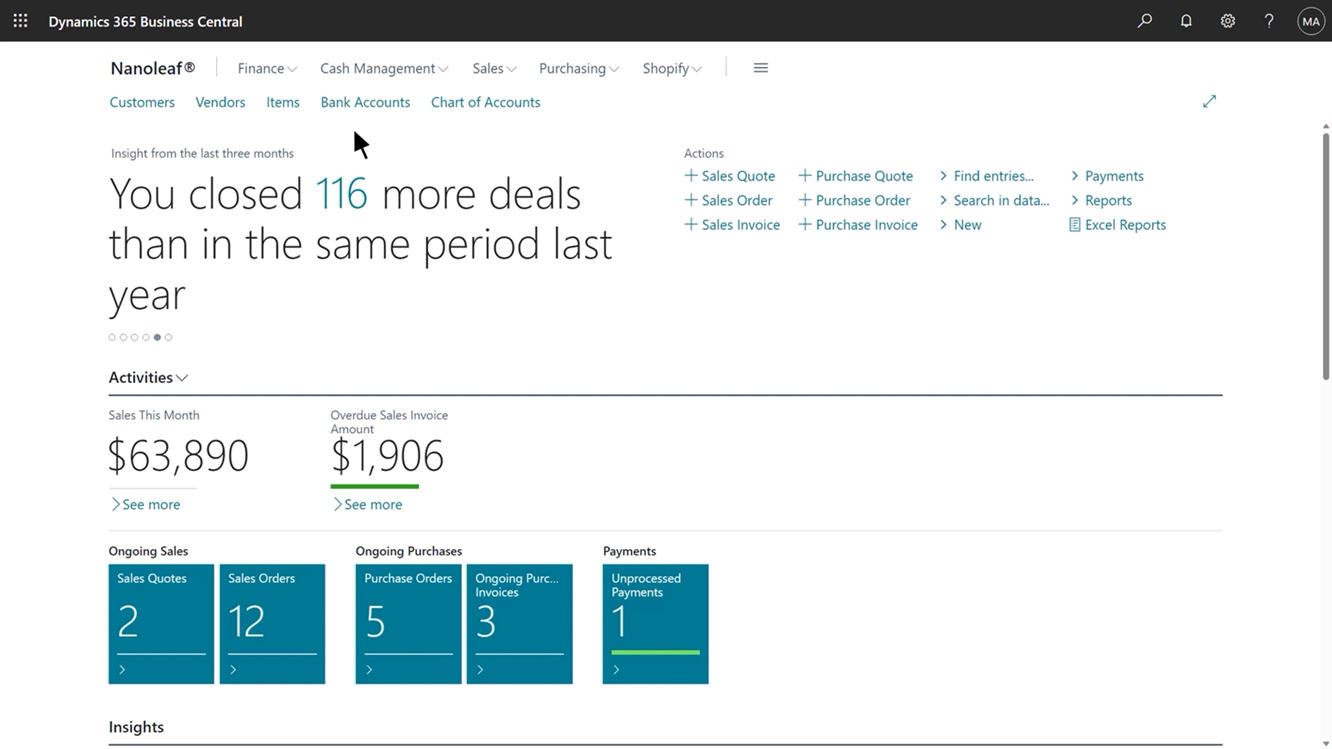

- Make NetSuite your lead actor: Take maximum advantage of NetSuite accounting software that can automate error-prone tasks, Improve the reconciliation process, provide real-time dashboards, turns monotonous tasks into repeatable automated functions, and integrate data and keep all information consistent.